Créditos fiscales del VA

Únete al programa

¡Empiece a trabajar en sus planes para 2025 para aprovechar el programa de crédito fiscal en beneficio de los estudiantes!

¿Quieres triplicar tu impacto?

- Una contribución de $28.500 se traduce en un crédito fiscal estatal de $18.500, lo que supone un desembolso total para usted de $10.000. El programa le permite triplicar su impacto.

- Una contribución de $2.850 da como resultado $1.850, lo que supone un desembolso total para usted de $1.000.

¿Qué es el programa de desgravación fiscal?

Si pagas impuestos en el estado de Virginia, puedes realizar unos sencillos trámites para que tus donaciones tripliquen su valor y ayuden a los estudiantes.

En Programa de crédito fiscal para becas de mejora de la educación en Virginia Esto es posible. El programa ofrece créditos fiscales estatales de 65% de sus donaciones a contribuyentes que donan para escuelas privadas acreditadas.

Este año, EMS tiene 68 estudiantes que son elegibles para recibir ayuda financiera de hasta aproximadamente $$8,096 (a través del apoyo de crédito fiscal).

Ayude a los estudiantes a acceder a una ayuda financiera de más de $460.000 a través del programa de crédito fiscal al considerar una contribución para EMS. Los créditos se conceden por orden de llegada.

Cómo funciona - 3 sencillos pasos

- Complete la Formulario de autorización previa y envíelo por correo a

Programa de crédito fiscal VA

Fundación Comunitaria de Harrisonburg- Rockingham

P.O. Box 1068, Harrisonburg, VA 22803. - Contribuya a través del Fundación Comunitaria en un plazo de 180 días, (después de haber recibido la aprobación del crédito fiscal) incluyendo una nota aparte con su preferencia para apoyar a los estudiantes de EMS que reúnan los requisitos. Tenga en cuenta que sus oficinas están cerradas los días 30 y 31 de diciembre.

- Solicite su crédito fiscal en Virginia cuando cumplimente su declaración de la renta (recibirá un certificado de desgravación fiscal del dpto. de educación).

Infórmenos de su participación para que podamos hacer un seguimiento de los créditos disponibles y darle las gracias.

¿Preguntas?

Comuníquese con Paul Leaman en el 540-236-6012 o Trisha Blosser en el 540-236-6024.

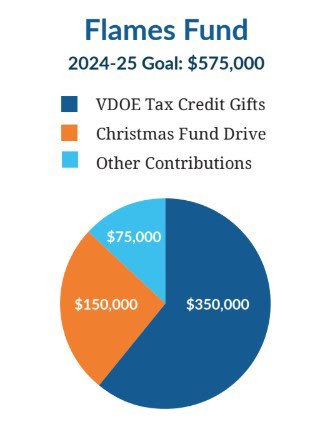

¡Tus donaciones en acción a través del FONDO FLAMES!

*Las contribuciones a través de este programa nos ayudan a alcanzar nuestros Fondo de llamas Objetivo de $575,00 para 2024-2025. Estas contribuciones financian la mayor parte de este objetivo y nos esforzamos por lograr contribuciones de crédito fiscal de $350,000 (¡o más!) este año para financiar la ayuda financiera para los estudiantes.

¿Por qué doy a través del programa...?

"El fiscal crédito nos ha permitido dar mucho más de lo que habríamos podido dar de otro modo.

Para nosotros, hemos contribuido hacia finales de año, alrededor de octubre o noviembre, y no recibimos el crédito hasta que hagamos la declaración de la renta. Ese retraso entre la contribución y crédito es importante tenerlo en cuenta. Aun así, nuestro resultado "de bolsillo" ha sido aproximadamente una cuarta parte de lo que recibe EMS, por lo que ha sido una gran manera de bendecir a la escuela y maximizar nuestra donación."

- Padre actual

"Cuando nos dimos cuenta de que podríamos triplicar nuestra aportación del año pasado a través del programa, ¡para mí fue una obviedad! Nuestra contribución tendrá un impacto más significativo para la escuela y el mismo efecto para nosotros de nuestro bolsillo."

Donante

¡Las contribuciones apoyan las experiencias de aprendizaje de EMS!

El 21 de septiembre, día internacional de la paz, se celebró el 19.º desfile anual de la paz de EMES. El tema elegido por los líderes estudiantiles de quinto grado fue: ¡Hay gente dulce en todas partes! En las últimas semanas, cada clase de EMES ha profundizado en esta historia especial de Alice Walker. Los estudiantes compartieron lo que han estado aprendiendo: personas de todo el mundo…